For more than a century, Americans have been conditioned to think of coal as a cheap and abundant energy source—and for much of that period it was true. However, the passage of time can change such things, and it has. Big time.

Today’s reality is, as the nation’s aged coal-fired power plants continue to get older, using coal for electricity generation has gotten more and more expensive. Like cars, homes, or most anything else, coal plants require more investment in repairs and maintenance as they age. These investments become an ever-greater portion of the power generation cost.

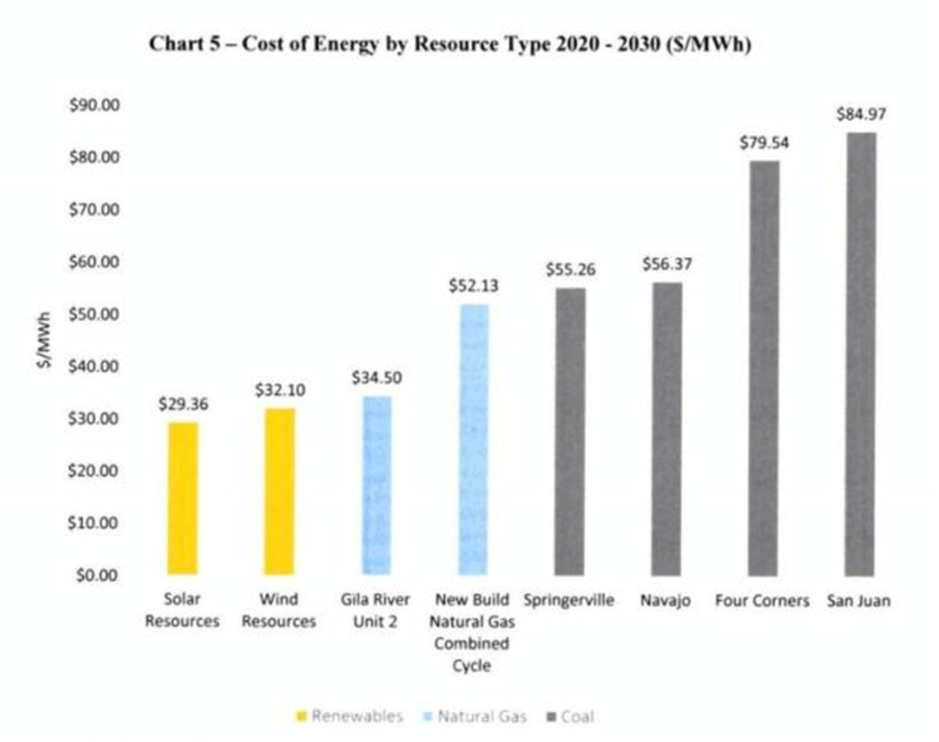

In Arizona, a recent filing by Tucson Electric Power (TEP) shows just how dramatic this reality is affecting the price of coal-generated electricity. TEP projects that the 2020 to 2030 cost of electricity from two of the primary coal plants it relies on, Four Corners and San Juan, will be $80 per megawatt hour (MWh) or more. In its cost chart (see below), TEP also projects power from new combined cycle gas plants to cost more than $50 per MWh, while solar power comes in at only $29 per MWh.

Regardless of where you live, if coal is a big part of your utility’s power mix, odds are it is causing your electricity rates to be higher than they should be.

The investment firm Lazard Asset Management, which keeps track of global energy prices, reports that the cost for electricity from coal-fired power plants can run as much as $143 per MWh.

By contrast, many solar contracts, especially in the Western U.S., are selling electricity for less than $25 per MWh. Even solar plants with battery storage for nighttime generation are beating coal and natural gas on price.

It is no wonder that coal’s share of the U.S. electricity mix fell from 48% in 2008 to 27% in 2018. By 2020 that share is projected to fall to 22 percent, according to the U.S. Energy Information Administration.

Stranded Assets

If energy markets functioned anything like most markets, it might be safe to assume that the lower priced energy source would always win. They don’t, and it’s not. There are forces at play that slow this transition and keep expensive, aging coal plants in business.

First, many electric utilities function as monopolies. There is no real competition. They do not have to worry about losing their customers to a competitor. Second, utilities are highly regulated, with most of their generation investments having been signed off on by a state utility commission.

These factors, along with shareholder and other overlapping interests, mean that utilities are not always that concerned about which energy choice is most cost-effective for the customer.

More often than not, electric utilities are more concerned about getting the maximum life out of their past investments. If a utility’s long-term financial plan assumes that a particular coal plant will have a 40-year lifespan, that utility will likely resist shutting it down early—even if the electricity it produces is far more expensive than other options, such as gas, solar or wind generation.

If a utility retires a power plant before its anticipated economic lifespan, it is considered a “stranded asset.” Utilities typically try to keep a plant running as long as possible to maximize their return on investment. This means that your electricity rates could be significantly higher than it should be because your utility is hanging on to expensive coal plants instead of investing in the cheapest available energy sources.

As ratepayers with a big stake in the cost of electricity, we need to insist that state utility commissions not allow expensive, non-competitive power plants to drive up electricity rates.

This dynamic is also a reason that utilities should resist investing heavily in new natural gas-powered plants. With electricity from solar already cheaper than that from gas (and still dropping), it will not be long until gas plants start becoming an impediment to lower electricity rates. In fact, the price of natural gas is expected to double over the next decade.

Utility commissions should avoid a future where utility interest in maximizing plant lifecycles is at odds with the best interest of the ratepayers they serve.

The cost of coal today is high, and you are probably seeing this reflected in your utility bills. It is wrong to saddle us with unnecessarily high electricity rates just to placate utility investors.

Of course, the cost of coal is high in other ways as well.

The pollution it produces is harming our atmosphere, making the air we breathe unhealthy, and contaminating the fish we eat with mercury. If that is not bad enough, mountaintop removal coal mining continues to alter landscapes, poison water supplies, and devastate communities across Appalachia.

Today, there are better and cheaper ways to power our homes—and most utilities recognize this. Some, however, are dragging their feet and require a firm nudge from ratepayers and their respective utility commissions.

Southern Company has already closed half of its Coal Burning Power plants and has committed to a date for all the rest.